At the center of retirement account tax Advantages is the fundamental difference amongst conventional and Roth cure. This difference applies across numerous account styles, from IRAs to 401(k)s and over and above.

Even though HSAs are mostly designed for healthcare fees, they rework into adaptable retirement accounts soon after age sixty five:

In this post, we’ll wander you through 10 confirmed strategies that can help safeguard your economic foreseeable future.

At Hammond Regulation Team, we’ve guided Colorado business owners via this process For some time. We’ve found how suitable planning can make the distinction between a company that thrives for generations and one that falters following its founder ways away. Should you haven’t commenced thinking of succession yet, now’s the time to start out.

“As knowledgeable property investor due to the fact 1969, I have been referring my shoppers to Asset Protection Support of America For some time… I like to recommend APSA to all my new and seasoned housing buyers alike.”

He delivers a amount of support and pleasure I could by no means reach by itself. Jay's exuberant and friendly persona can make working with him pleasurable, and he is often prepared to lend a helping hand. I can not propose him very more than enough to any one needing his services

Wealth Preservation for Business people Though not normally a favourite matter of discussion with business owners, organization preservation strategies are also important, especially if the founder hopes to Secure retirement planning go down the corporation.

For more mature relations, very long-phrase care insurance coverage may help pay for the expense of dwelling healthcare personnel or nursing property stays. This insurance coverage can assist be certain that you don’t must deplete savings and investments to protect these ongoing charges.

Getting access to distinctive account types with different tax remedies supplies crucial flexibility in the course of retirement. With a mixture of traditional and Roth accounts, you may strategically withdraw from various sources depending on your once-a-year tax situation.

What helps make this approach Distinctive is its dual contribution composition – you may add equally being an employer and an employee:

Roth accounts flip the tax edge towards the again stop of your respective retirement journey. With Roth accounts, you lead right after-tax bucks, that means there’s no rapid tax deduction after you make contributions.

One particular strategy is to build an “all-weather” portfolio that performs fairly perfectly in different economic situations. This may well contain a mix of stocks, bonds, real estate property, and maybe some alternative investments.

The trade-off will come later in everyday life, while you’ll pay back normal cash flow taxes whenever you withdraw resources in retirement. This method is especially helpful should you count on to get within a lessen tax bracket all through retirement than that you are in the course of your Performing years.

Among the most missed retirement planning cars isn’t technically a retirement account in any respect. The Wellness Savings Account (HSA) delivers unparalleled tax performance that makes it a powerful ingredient of retirement planning.

Tahj Mowry Then & Now!

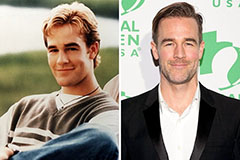

Tahj Mowry Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!